| The international community is on fire again over the period of peak oil triggered by Donald Trump. Former U.S. President Donald Trump, a Republican candidate in the U.S. presidential election, is calling for pro-oil policies, including the abolition of subsidies for electric vehicles and increased production of crude oil.

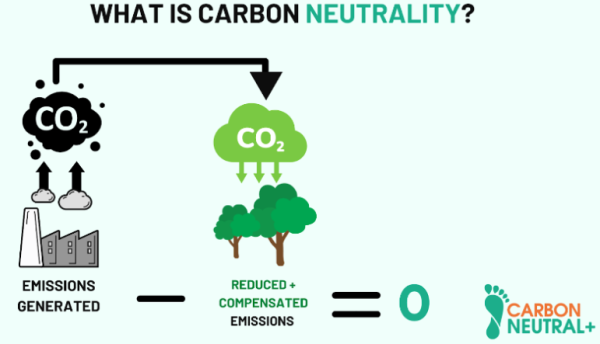

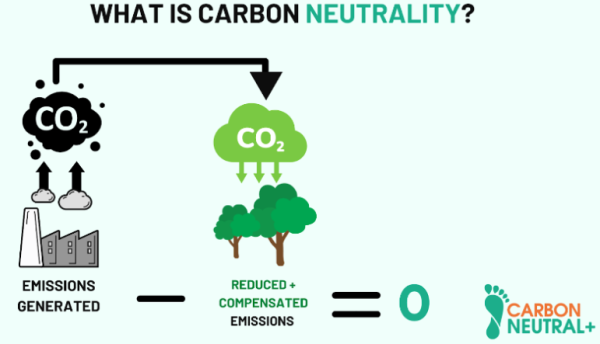

In the international energy industry, voices have been gaining strength in recent years that the timing of oil will soon end due to the strengthening of carbon neutrality, but opinions are divided over peak oil as the next U.S. government's policy direction is likely to change significantly.

Oil-producing countries believe oil demand will rise over the next 20 years as industrial demand in emerging markets increases and electric vehicle supply slows down due to a temporary stagnation in demand.

However, the International Energy Agency (IEA), centered on developed countries that have insisted on 2050 carbon neutrality, warns that if this continues, there will be no place to use the oil produced and will suffer from “oversupply.”

Global investment bank Goldman Sachs also entered the battle by offering a compromise.

According to the industry on the 13th, in a recent report forecasting the oil market by 2030, the IEA predicted that “oil consumption will peak at 105.6 million barrels per day in 2029 as the number of electric vehicles increases, and the role of oil in electricity production is reduced due to the expansion of renewable energy such as solar power and nuclear power plants.”

In October last year alone, the IEA predicted the peak oil period to 2030, which is about a year earlier.

However, OPEC said, "By 2045, oil demand will increase by 25 million barrels a day in developing countries alone," adding, "10 million barrels are expected to increase in China and India alone."

"Contrary to the IEA's earlier projection of a peak demand for gasoline in 2019, demand for gasoline not only hit a peak in 2023 but is still rising this year," OPEC Secretary General Hytham Al-Gais said.

Amid the tight arguments from both sides, Goldman Sachs predicted that "oil demand will peak at 110 million barrels per day in 2034, and that it is expected to continue at a similar level for several years after 2035.

Goldman Sachs predicted that the peak oil period will be delayed to 2040 (113 million barrels) if the spread of electric vehicles slows down.

Key Takeaways on Peak Oil:

- Debate reignited: The potential for peak oil, a decline in global oil demand, is back in the spotlight, fueled by Donald Trump's pro-oil policies and opposing views on the future of energy.

- Contrasting perspectives:

- Oil-producing countries: Predict rising oil demand for the next 20 years due to emerging market growth and electric vehicle production delays.

- IEA: Warns of oversupply and an inability to utilize future oil production if 2050 carbon neutrality goals are achieved.

- Timing discrepancies:

- IEA: Forecasts peak oil in 2029, a year earlier than its previous prediction.

- OPEC: Predicts rising oil demand until at least 2045, particularly in developing countries.

- Goldman Sachs' compromise: Predicts peak oil in 2034, with demand remaining stable for several years after. The bank also suggests peak oil could be delayed to 2040 if electric vehicle adoption slows.

- Key factors impacting predictions:

- Growth of electric vehicles.

- Expansion of renewable energy sources.

- Industrial demand in emerging markets.

- Ongoing debate: The timing of peak oil remains uncertain and subject to ongoing debate, with significant implications for energy policy and investment.

Tags: Carbon Neutrality IEA International Energy Agency OPEC Oil Consumption Oil Peak

|  6,782

6,782  0

0  0

0  1922

1922